In a desperate attempt to reverse a clause in the president’s flagship legislation that will harm gamblers when it takes effect next year, a few Las Vegas casino executives and the leading lobbyist for the industry in Washington, D.C., met with a senior congressional representative.

U.S. Rep. Jason Smith, R–Missouri, chair of the House Ways and Means Committee, met with Derek Stevens of Circa, Golden Gate, and The D; Bill Hornbuckle of MGM Resorts; Tom Reeg of Caesars Entertainment; Craig Billings of Wynn Resorts; and Bill Miller, president of the American Gaming Association, on Monday to advocate for the reinstatement of the 100 percent deduction for gambling losses, which was lowered to 90 percent under the One Big Beautiful Bill Act. The modification will be applied to tax returns filed in 2026 and will formally take effect on January 1.

ALSO READ: Aurora Increases Gaming Limits, Creating New Competition for Illinois Casinos

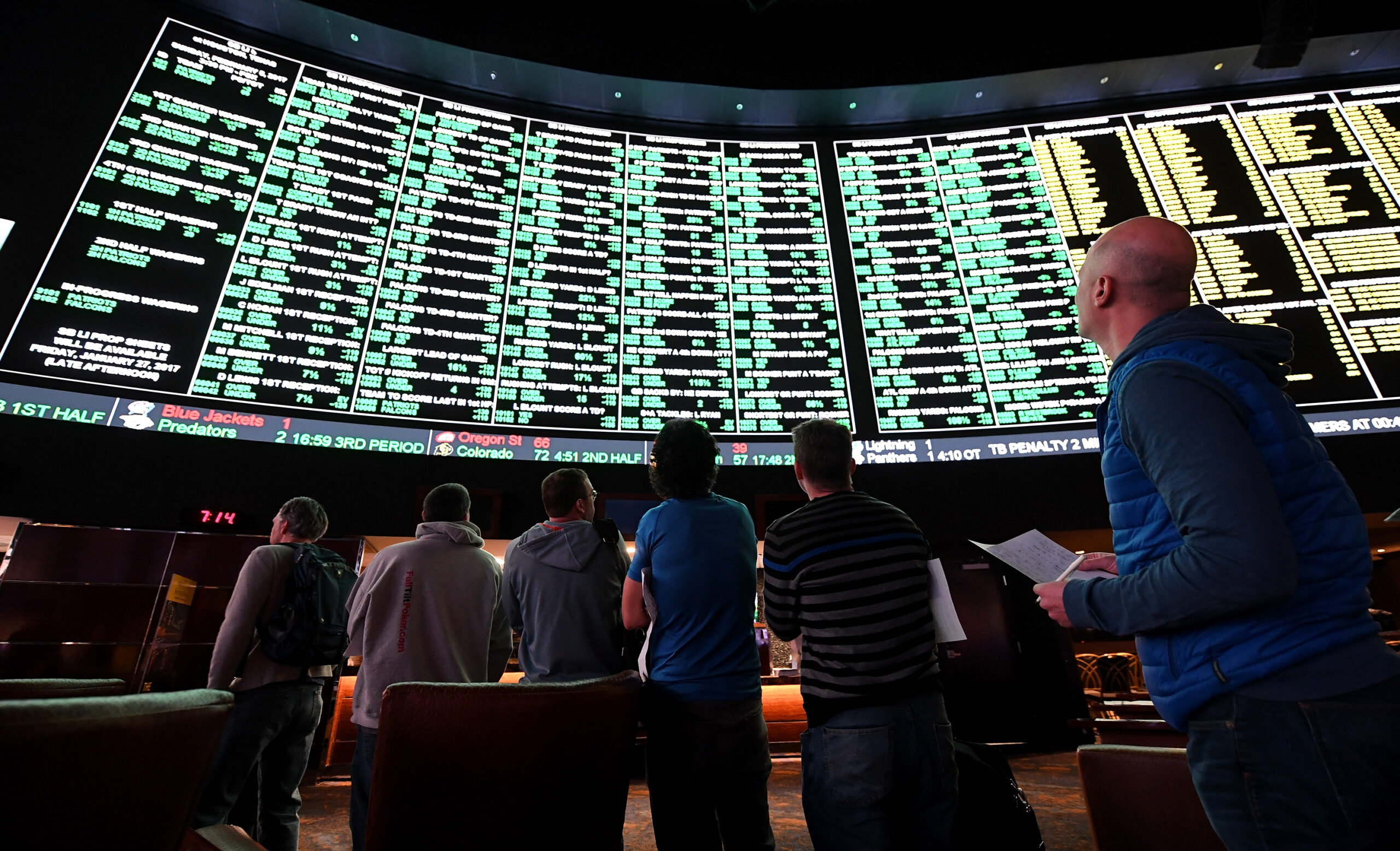

The reform unfairly targets high-stakes players and professional gamblers, who will now have to pay taxes on unrealized earnings, according to tax experts and representatives of the gambling sector. Industry analysts predict that poker gamers, high-limit slot machine players, and sports bettors will be the most negatively impacted.

The effects of the measure are already being seen, according to Stevens, who co-owns and runs three casinos in downtown Las Vegas.

He stated on Thursday, “It’s frightening to think that we’re already being impacted by groups not booking because they’re afraid of dealing with this issue,” pointing out that a number of wealthy sports gamblers are avoiding futures bets on 2026 events like the Super Bowl and March Madness as a result. “I’m trying to make a push because it’s obvious that this will affect tourism here and across the nation.”

Courtesy: https://www.covers.com, https://www.casino.org, https://pechanga.net