The 2024 U.S. election thrust prediction markets like Kalshi and Polymarket into the spotlight. With Trump’s win and shifting regulation, they’re now moving beyond politics, targeting sports betting—and confronting fierce resistance from regulators, states, and gaming tribes.

Not much about the 2024 US presidential election was expected, least of all the withdrawal of incumbent Joe Biden and the appearance of vice president Kamala Harris in his place. The highly turbulent contest was difficult for statistical models and polling to predict.

Prediction markets rushed into this empirical wilderness. A website and the knowledge of a throng eager to deposit were all they needed to quantify the contest.

In order to trade against one another on the results of win/lose events, bettors purchase “shares” on these platforms; as more predictions are made, the prices of the shares change. Since each winning share is redeemable for $1, its market price can be interpreted as a probability; for instance, a share valued at 25 cents indicates a 25% chance that the event will occur. Transaction fees are how the market operators profit.

ALSO READ: The Rules Committee has ruled against the Gambling Deduction FAIR BET Act.

The biggest of those authorized to function as “designated contract markets” in the United States was Kalshi. Its primary market saw the trading of presidential election futures valued at over $500 million. More than $3.6 billion was exchanged on Polymarket, a competing cryptocurrency-based marketplace that is supposedly closed to Americans. Both of them picked Donald Trump as the favourite, and he seemed to glow when he won in November, earning some bettors millions of dollars.

Since then, Kalshi and Polymarket have forged relationships with the victorious government. Donald Trump Jr., who is also an investor in Polymarket and a member of its advisory board, was brought on as a strategic consultant by Kalshi in January.

However, the previous administration was not very interested in permitting election wagers. The New York-based startup won a legal battle just before election day after the Commodity Futures Trading Commission, the US derivatives regulator, attempted to shut down Kalshi’s markets on congressional elections.

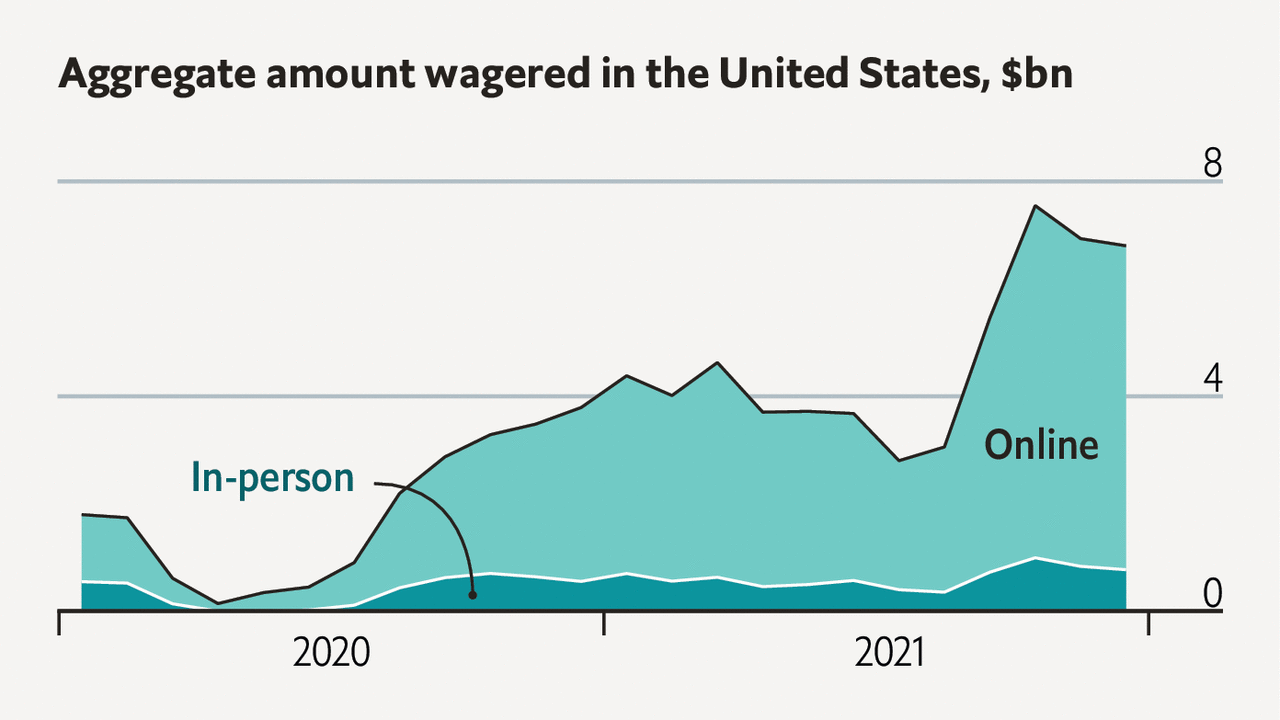

However, political betting was always going to be a niche business; sports betting offers a much larger payout for prediction markets, and Kalshi is leading the charge to capture a portion of the $14 billion US market. The business launched its first sports markets on the Super Bowl early this year.

Under the new administration, Kalshi and its competitors have not faced much resistance from the regulator, despite the seemingly unambiguous legislative language that prohibits markets that include “gaming.” Brian Quintenz, President Trump’s pick to run the CFTC, sits on Kalshi’s board.

The prediction exchanges’ offensive on sports gambling, however, has other parties extremely alarmed. This has put Kalshi at the centre of a new round of legal battles with a new group of opponents, including states, gaming regulators, and Native American tribes, who control a large portion of the US gaming market.

Courtesy: https://www.covers.com, https://www.casino.org, https://pechanga.net